How to get a business tax wholesale number?

As a business owner, you most likely have experienced already that opening and running a company comes with a lot of paperwork. One of these important documents is carrying your tax identification number.

Are you already or just considering selling products business-to-business? Then this article has been written just for you!

We are going to disclose different types of tax identifications and why it is important for you to have a wholesale number if you are selling B2B.

But first thing first:

Table of Contents

What Is a Tax ID Number?

A Tax ID Number or so-called TIN is a special identification code that is used in the business world mainly at different tax administrations. You would need a number of this sort to fill out a tax return, claim treaty benefits or open a business bank account. In the states, TINs are issued by the Internal Revenue Service (IRS).

Important to highlight, that for businesses, a Tax ID Number is the same as the Employer ID Number (EIN)

TIN equals Central Business Register (CVR) number in Denmark, issued by The Danish Business Authority (Erhvervsstyrelsen). In the Netherlands, they use the BWT-number for Vat and tax turnover purposes provided by the Dutch Tax Administration. While in Germany, the Steuer-IdNr., IdNr. or Steuer-ID referring to the German word Steueridentifikationsnummer is used as the employers’ tax ID. As a global standard, we can see that each country has its own tax identification number and a somewhat similar system that provides VAT or tax benefits in the B2B environment.

Do I have to have a Tax ID to buy wholesale?

A TIN/ EIN and a business tax wholesale numbers are not the same things. Nevertheless, to have a wholesale number, a company first requires a TIN. To decide if you really need to take that extra mile and register also for a wholesale number is very easy.

In case, your company is purchasing goods that then you are reselling to others, the answer is YES. – You should register for a business tax wholesale number.

The main point of having a wholesale number is not to pay taxes on products that you won’t use directly in your business. Instead, you are going to retail it to other individuals or companies with no or minor changes.

How to get a Tax ID in wholesales?

These are the steps you should follow to become authorized for tax-exempt wholesale purchases:

- Apply for an employer identification number (EIN)

- Apply for a Certificate of Exemption

- To be specific, you will need a sales tax exemption certificate

- Apply for your reseller certificate

For each step after step 1, you will need your TIN. So better to have it by hand from the beginning. This unique 9-digit number is stated in multiple official papers. In case you forgot it, you can either call IRS (other state offices), check your EIN confirmation letter, or check other documents your EIN has already recorded.

I’m spending a year dead for tax reasons.

— Douglas Adams

Can I buy wholesales with EIN?

You can avoid having an EIN as a business only in a few cases. For example, if you are running a single-person company, and sole proprietors are taxed as individuals, therefore, they don’t need an EIN. Nevertheless, as soon as you would like to open a company bank account as a non-individual taxpayer, you will need to register for a TIN.

To register for a CVR number, you can wait until you are due to register for paying VAT or exercise any tax-related activities such as paying salaries.

Since the point of using a wholesale number is to circumvent paying taxes on products that you purchase for NON-personal use. You will need an EIN/TIN/CVR before you can apply for a wholesale number. Once you have that, then you can start paying less for the products you are retailing.

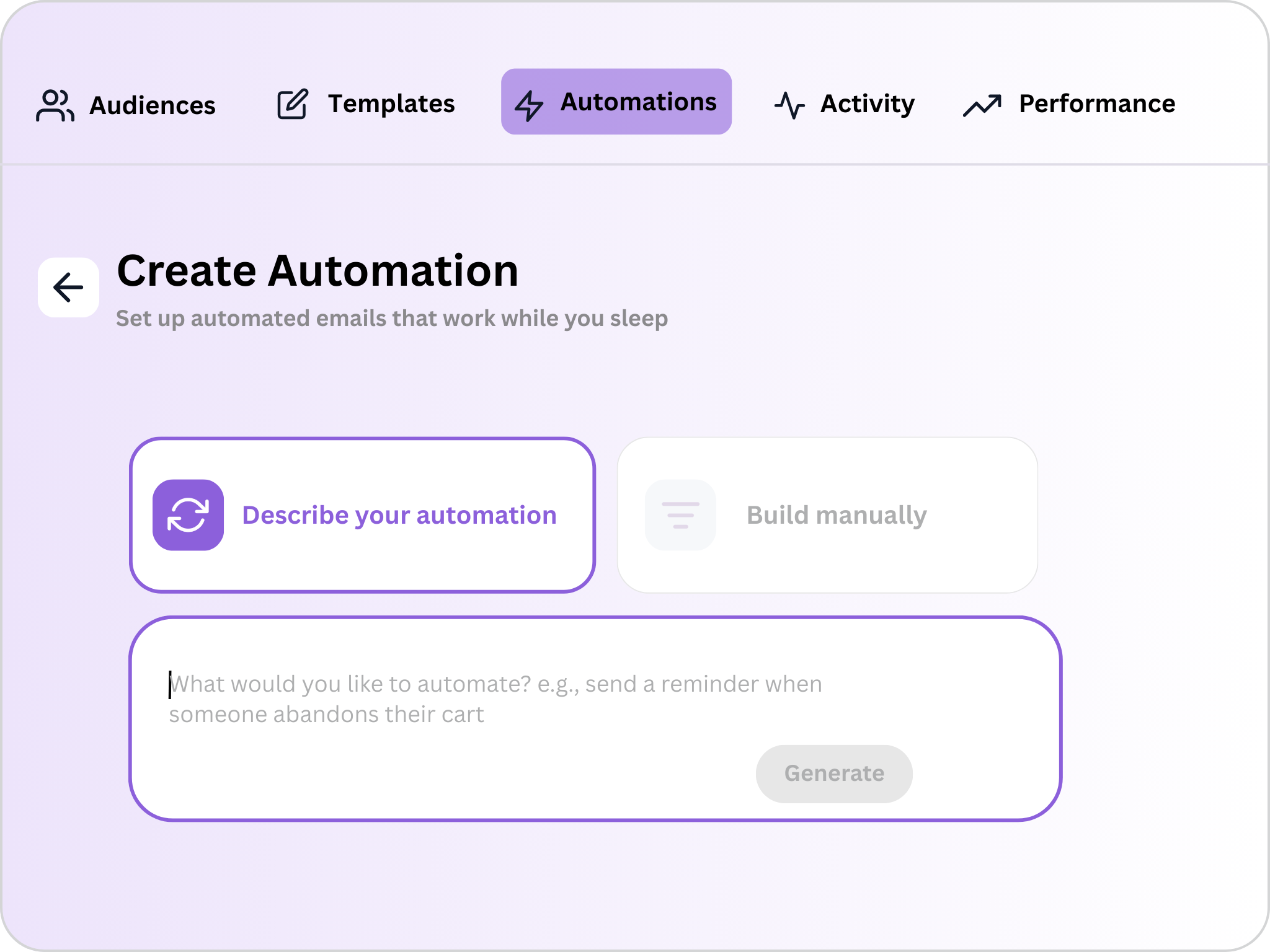

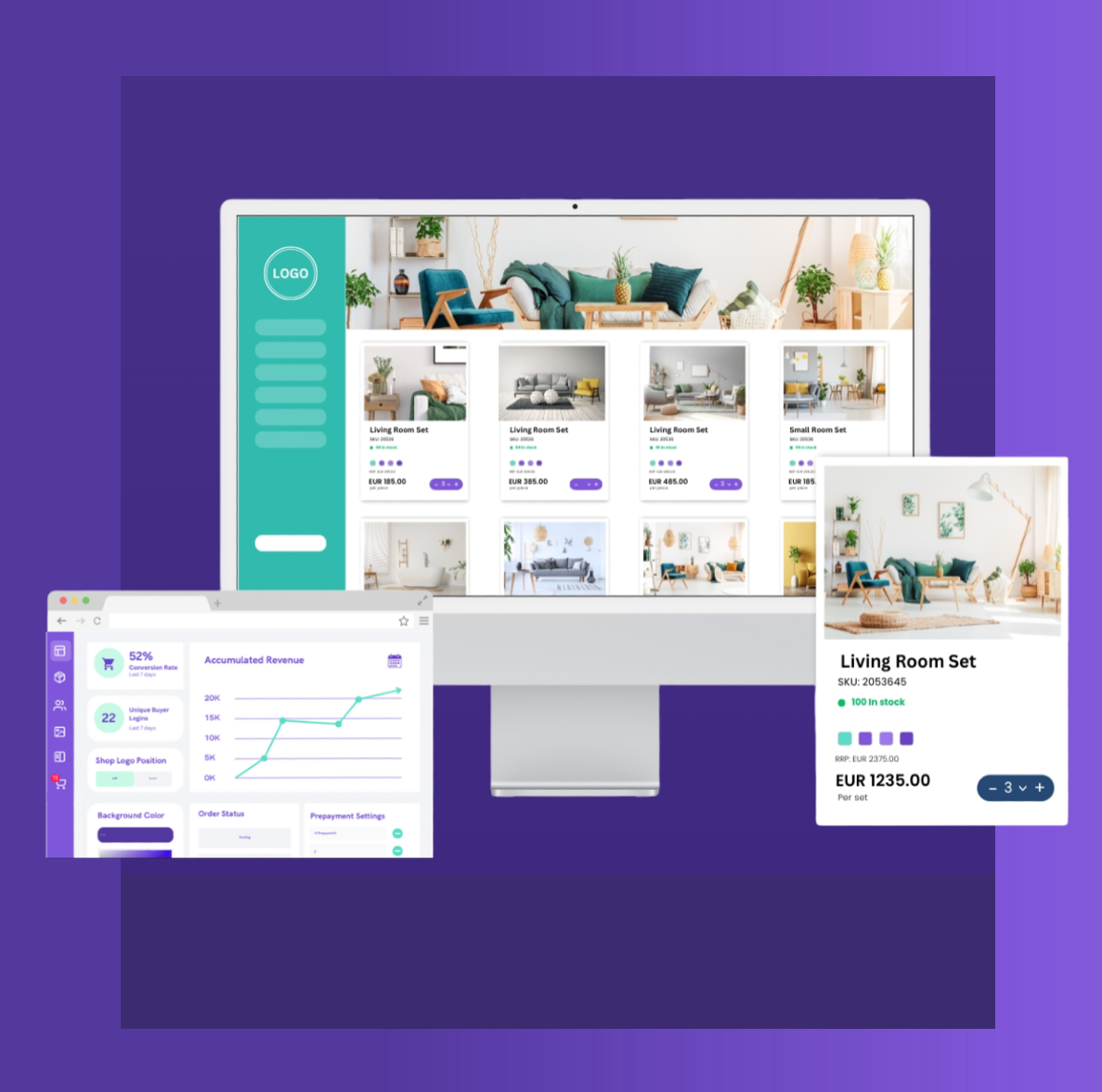

Good news is that to build your own B2B eCommerce platform with Turis you won’t need either a reseller certificate or a TIN/ EIN/ CVR.e it!

We would love to continue the dialogue and show you what Turis is all about and more importantly: How Turis can help your business grow. Book a meeting with Casper below, or expand your knowledge of wholesale in a digital world with our blog post on what is wholesale?

Launching Your First B2B Store?

Let us launch your B2B store with us today and boost your sales – no coding needed, just expert guidance with our People-to-People support every step of the way.

Book personal demo

RELEVANT POSTS