How Much Are You Losing on Your EDI Orders?

The hidden revenue leak that’s costing B2B eCommerce businesses millions in unnoticed losses.

Every day, thousands of B2B eCommerce businesses automatically accept EDI orders without questioning a critical detail: are the prices their customers are paying actually correct? While Electronic Data Interchange has revolutionized B2B commerce by streamlining order processing and eliminating manual data entry, it has also created an unexpected vulnerability that’s silently leaking profits from suppliers worldwide.

Recent industry research reveals a startling reality: companies typically lose 1-5% of their annual EBITDA to pricing discrepancies in EDI transactions, with 66% of businesses losing up to €500,000 yearly from pricing errors alone. For a mid-sized B2B eCommerce operation with €50 million in annual revenue, this translates to potential losses of €2.5 million annually – money that simply leaks away through the gap between what customers should pay and what they actually pay.

The most troubling aspect? Most suppliers don’t even realize the leak exists.

Table of Contents

- The Scale of the EDI Pricing Problem in B2B eCommerce

- Why EDI Orders Put Your Pricing at Risk

- The True Cost: Real-World Impact on B2B eCommerce Businesses

- Industry Variations: Where the Risk Hits Hardest

- The Compounding Effect: Small Errors, Big Annual Losses

- How Turis Plugs the EDI Pricing Leak

- The Solution: Bringing Transparency to EDI Pricing

- Taking Action: Plugging Your EDI Revenue Leak

- Want to learn more about Turis and EDI for B2B eCommerce?

The Scale of the EDI Pricing Problem in B2B eCommerce

Unlike traditional B2B eCommerce orders where your system controls pricing, EDI fundamentally shifts this responsibility to the customer. When your retail partners send EDI purchase orders, they include their own pricing data – prices stored in their systems, not yours. This seemingly innocuous detail creates a massive vulnerability that industry research shows affects 5-30% of all EDI orders depending on the supplier’s validation practices.

The statistics paint a concerning picture across different company sizes:

- Small B2B eCommerce suppliers (under €10M revenue): 25-35% experience regular pricing discrepancies

- Mid-market companies (€10M-€100M): 15-25% face systematic pricing errors

- Large enterprises (€100M+): 5-15% still struggle with validation gaps

Manufacturing giant Osborn LLC discovered their EDI pricing error rates exceeded 30% before implementing proper validation systems – a figure that industry research confirms as typical for companies relying on manual processes or basic EDI integration without comprehensive price checking.

Healthcare suppliers face the worst exposure, with claim denial rates averaging 10-20% and hospitals losing an average of €5 million annually to unresolved pricing discrepancies. Even well-automated sectors like automotive still face material losses, with just-in-time manufacturing requirements amplifying the cost of every pricing error through production delays and penalty charges.

Why EDI Orders Put Your Pricing at Risk

The fundamental difference between traditional B2B eCommerce orders and EDI transactions lies in pricing control. In your standard eCommerce platform, your system determines pricing based on customer agreements, current price lists, and promotional rules. When a customer places an order, your system calculates the correct price automatically.

EDI flips this model entirely. Your customer’s procurement system generates the purchase order complete with line-item pricing, quantities, and terms. This pricing comes from their internal systems – systems that may not reflect your current price lists, recent negotiations, or contract amendments. Essentially, your customers are telling you what they plan to pay, rather than asking what they should pay.

This creates multiple failure points where pricing errors infiltrate the transaction:

Outdated Contract Pricing: The most common error occurs when customer systems fail to update pricing before new contract terms take effect. A electronics manufacturer discovered they’d been undercharging for two years due to a decimal truncation error in their customer’s system – a mistake that cost hundreds of thousands in lost revenue.

Manual Input Errors: Despite EDI automation, human intervention still affects up to 5% of invoice data even in automated environments. Currency conversion mistakes, unit-of-measure discrepancies, and complex discount calculations create cascading errors.

System Misconfigurations: Technical glitches silently erode margins. Rounding errors, database synchronization failures, and integration bugs can persist for months before detection.

Intentional Under-pricing: Some buyers deliberately submit below-contract prices, knowing many suppliers lack real-time validation capabilities.

The True Cost: Real-World Impact on B2B eCommerce Businesses

The financial impact extends far beyond simple arithmetic errors. Boston Consulting Group research reveals that 45% of executives identify revenue leakage as a systematic problem, with the cascading effects touching every aspect of B2B eCommerce operations.

Consider a typical scenario: A consumer goods supplier receives an EDI order for 10,000 units at €12.50 each, totaling €125,000. Their actual contract price should be €13.15 per unit, or €131,500. This seemingly small €0.65 difference represents €6,500 in lost revenue on a single order – and if this error persists across similar orders throughout the year, the annual impact easily reaches six figures.

The problem compounds through volume effects. EDI orders are typically larger than standard B2B eCommerce transactions, making each pricing error more costly. A packaging supplier discovered they’d been accepting 15% below-contract pricing on their largest customer’s EDI orders for eight months, resulting in €400,000 in unrecovered revenue.

Beyond direct revenue loss, suppliers face escalating EDI chargeback penalties that have transformed from cost recovery mechanisms into retailer profit centers. Major retailers routinely charge €100 or more per document containing errors, with some suppliers accumulating six-figure annual penalties. The automotive industry’s “speedy points” system goes further, passing production downtime costs directly to suppliers whose pricing errors disrupt just-in-time manufacturing.

Hidden costs multiply through manual correction processes, dispute resolution overhead, and damaged trading relationships. True Brands documented €60,000 in annual savings just by eliminating manual processing for Walmart orders, while still facing pricing risk without proper validation.

Industry Variations: Where the Risk Hits Hardest

Different B2B eCommerce sectors face varying degrees of EDI pricing risk, creating distinct risk profiles that smart suppliers must understand:

Healthcare emerges as the highest-risk environment, with complex multi-stakeholder requirements and strict regulatory compliance creating numerous failure points. The sector’s 10-20% error rates stem from varying payer requirements, promotional pricing conflicts, and the complexity of medical product codes. However, healthcare also offers the greatest ROI potential from validation investments, with documented savings of €1.49 per claim for physicians and €0.86 per claim for hospitals.

Manufacturing occupies the middle ground, with 30-40% error reduction possible through proper EDI implementation. Complex multi-tier supply chains and just-in-time requirements create ongoing pricing challenges, particularly around volume discounts and engineering change orders that standard validation tools struggle to handle.

Retail B2B eCommerce demonstrates more mature EDI practices but massive transaction volumes amplify impact. The sector’s focus on promotional pricing and seasonal variations creates unique validation challenges, with a 250-store retailer potentially saving 65,000 receiving hours annually through proper implementation while still facing pricing accuracy issues.

Automotive achieves the lowest error rates through established protocols, yet maintains zero tolerance for production disruptions. Even small pricing discrepancies trigger severe penalties, making validation accuracy paramount rather than optional.

The Compounding Effect: Small Errors, Big Annual Losses

What makes EDI pricing errors particularly insidious is their compounding nature. A 2% pricing discrepancy might seem manageable on individual orders, but when applied across hundreds or thousands of EDI transactions annually, the impact becomes staggering.

Consider a mid-sized B2B eCommerce supplier processing 2,000 EDI orders annually with an average value of €15,000 each:

- Total annual EDI volume: €30 million

- 2% average pricing discrepancy: €600,000 in annual losses

- 5% of orders affected: Still €150,000 in annual revenue leakage

Industry data shows that best-in-class companies achieve error rates under 5%, while laggards suffer 20-30% error rates. Each percentage point represents hundreds of thousands in lost revenue for mid-sized suppliers, making the business case for validation crystal clear.

The temporal aspect amplifies the problem further. Pricing errors often persist for months before detection, during which time the supplier continues accepting below-contract pricing. A consumer packaged goods manufacturer discovered a 3% systematic undercharge that had persisted for 14 months across their second-largest EDI customer, resulting in €280,000 in unrecovered revenue.

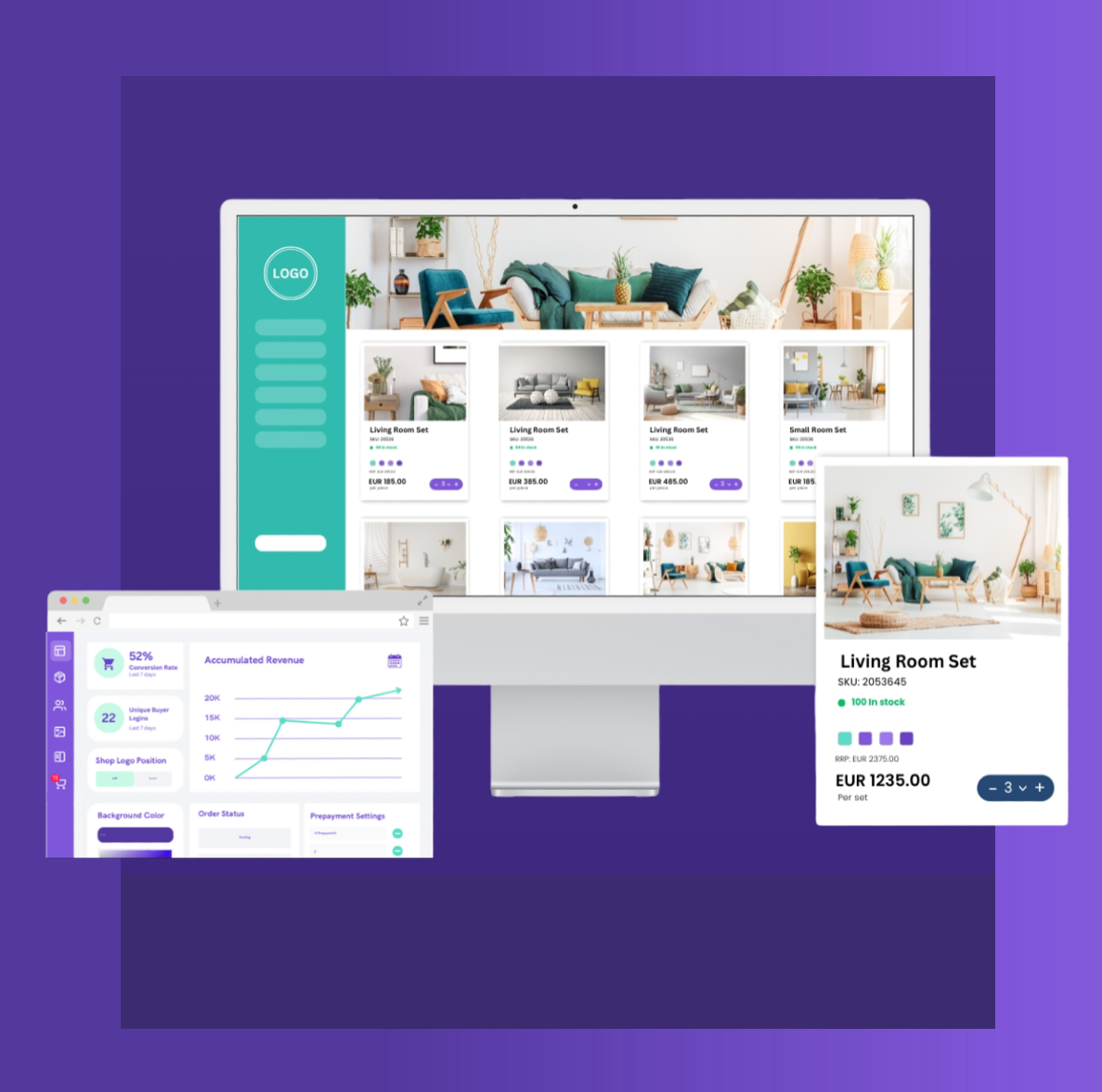

How Turis Plugs the EDI Pricing Leak

When an EDI order arrives through Turis, the system automatically:

- Translates technical EDI data into a clean, intuitive interface that demystifies what the order actually contains

- Compares incoming prices side-by-side with your current contract terms and price lists

- Highlights discrepancies immediately with clear visual indicators showing where customer pricing differs from your records

- Calculates the financial impact of each pricing variance, showing exactly how much revenue is at risk

- Enables instant action by allowing users to flag orders, contact customers, or request price updates before accepting

This transparency transforms EDI from a “black box” process into a controlled, visible workflow where pricing accuracy becomes manageable rather than mysterious.

Democratizing EDI Price Control for All Business Sizes

Traditionally, comprehensive EDI price validation has been accessible only to large enterprises with significant IT resources and complex validation systems. Turis changes this dynamic by building sophisticated price checking directly into an intuitive B2B eCommerce platform that small and medium businesses can easily adopt and use.

The system requires no technical expertise to operate. When a pricing discrepancy appears, users see exactly what the customer is trying to pay versus what they should pay, with the difference calculated automatically. This enables immediate decision-making: accept the order as-is, contact the customer for a price correction, or hold the order pending resolution.

Real-Time Protection Against Revenue Leakage

Unlike traditional EDI systems that process orders automatically, Turis creates intelligent checkpoints that catch pricing errors before they become revenue losses. The platform:

- Validates every line item against current pricing agreements

- Flags promotional pricing conflicts that might indicate outdated customer data

- Identifies suspicious pricing patterns that suggest systematic errors

- Provides audit trails showing when and how pricing decisions were made

- Enables bulk corrections when systematic pricing issues are discovered

This proactive approach transforms pricing validation from a reactive audit process into a real-time protection system that prevents revenue leakage at the source.

Measurable Impact for B2B eCommerce Operations

Early Turis implementations demonstrate immediate, measurable results. Companies using the platform’s EDI price validation typically see:

- 40-60% reduction in pricing errors within the first quarter

- 15-25% improvement in profit margins on EDI orders

- Elimination of surprise pricing discoveries during monthly reconciliation

- Faster customer price negotiations enabled by real-time discrepancy identification

- Reduced administrative overhead from pricing dispute resolution

The return on investment proves compelling across all business sizes, with small suppliers often seeing the fastest payback periods due to their higher baseline error rates and limited existing validation infrastructure.

The Solution: Bringing Transparency to EDI Pricing

The fundamental challenge with traditional EDI implementations lies in their opacity. Most B2B eCommerce platforms treat EDI as a black box – orders arrive electronically and flow directly into fulfillment systems without human review or price validation. This automation efficiency comes at the cost of pricing accuracy and creates systematic revenue leakage.

Modern B2B eCommerce platforms like Turis are evolving to address this critical gap by providing intelligent interfaces that demystify EDI transactions. By translating complex EDI messages into user-friendly formats and automatically comparing incoming pricing against current contract terms, suppliers can finally see what their customers are actually paying versus what they should be paying.

This transparency enables immediate action when discrepancies arise. Instead of automatically accepting incorrect pricing, suppliers can flag orders for review, contact customers for price updates, and ensure every transaction reflects current contract terms. The impact is immediate and measurable – companies implementing comprehensive price validation typically achieve 30-40% improvement in data accuracy and 50-60% reduction in pricing errors.

The technology investment pays for itself quickly. Implementation costs range from thousands to hundreds of thousands of euros depending on complexity, but ROI timelines of 6-24 months make this investment imperative rather than optional. A electronics distributor calculated their price validation system paid for itself in four months through captured pricing discrepancies.

Taking Action: Plugging Your EDI Revenue Leak

The research definitively shows that B2B eCommerce suppliers accepting customer-sent EDI pricing without validation face systematic revenue leakage that directly impacts profitability. The question isn’t whether your company experiences EDI pricing errors – industry data confirms virtually all suppliers face this challenge. The question is how much revenue you’re willing to lose before taking action to plug the leak.

Turis provides the tools needed to transform EDI from an opaque, risky process into a transparent, controlled workflow where pricing accuracy becomes achievable for businesses of all sizes. Starting with intelligent price comparison and exception handling, companies can immediately begin capturing revenue that would otherwise leak away through unnoticed pricing discrepancies.

The most successful implementations combine automated validation with intelligent user interfaces that make EDI pricing transparent and actionable. Turis’s approach democratizes this capability, making enterprise-grade price validation accessible to small and medium businesses that previously couldn’t afford comprehensive EDI protection.

For B2B eCommerce businesses serious about protecting their margins, the path forward is clear: implement robust EDI price validation or continue quietly losing hundreds of thousands in annual revenue to preventable pricing errors. The technology exists, the ROI is proven, and every day of delay represents more money leaking out through unnoticed pricing discrepancies.

The only question remaining is: how much are you losing on your EDI orders, and when will you start plugging the leak?