How can you benefit from SEPA payments in B2B sales?

Before we jump into the details of SEPA B2B Direct Debit payments, let’s see first what does SEPA really means.

SEPA basically includes the scheme put in place by the European Union and the European Payments Council. To make international payments in Euros easier and to ensure that all electronic payments in Euros have the same fixed price throughout SEPA nations.

In one sentence, the agreement aims to harmonize the way cashless euro payments across SEPA countries.

But first thing first: what are the benefits when it comes to B2B selling and buying?

Table of Contents

How does SEPA work in the B2B environment?

Many elements have changed and been added to the SEPA agreement since 2014 when the agreement was published.

However, the most essential aspect of the SEPA method is still the so-called International Bank Account Number (IBAN). This is a universally constructed account number for account holders in nearly all SEPA countries.

Another important characteristic is the Business Identifier Code (BIC). This allows banks to be uniquely identified. Private persons may now make transfers to accounts in other European nations considerably more simply than before by using the BIC.

These can be handy information to share with your retailers when it comes to invoicing them or offering them SDD.

What are the SEPA countries?

SEPA is for everyone!

Okay, maybe not for everyone, but all the 27 EU member states plus Andorra, Iceland, Norway, Switzerland, Liechtenstein, Monaco, San Marino, United Kingdom, Vatican City State, Mayotte, Saint-Pierre-et Miquelon, Guernsey, Jersey, and the Isle of Man are included in the SEPA countries.

Thanks to the union, more than 300 million customers, 15 million businesses are involved in the SEPA payment processes. That is why it is important that your wholesale company also supports this payment method.

Countries outside the euro region can also profit from the agreement by extending the applicability of this law to their native currency. Sweden and Romania, for example, have taken this path.

In case your B2B e-commerce is serving retailers not only countries in the eurozone, then providing a platform with flexible currency settings is a must. Therefore, it is quite handy that you can set the right currency and price for all your retailers in your Turis account.

What is a SEPA account?

A SEPA bank account can be any traditional bank account or any online-only bank account such as an account at Danske Bank, Nordea, Swedbank, Revolut, N26 etc…

Nevertheless, if you’re creating an online-only bank account, make sure it supports SEPA payments and SEPA credit transfers or is labelled as a SEPA bank account. Surprisingly, not all European banks are members. Even though, they are established in one of the SEPA countries.

However, if you live in the SEPA zone and your bank is a SEPA member, your bank account is automatically a SEPA bank. At least in the sense that electronic payments in Euros will fall under the SEPA scheme. This way, you can not only save time but also cut transaction costs.

To maximize the users’ revenue, you should make sure that your bank or other integrations are not collecting unnecessary fees. Turis for example doesn’t charge transaction fees, but other eCommerce service providers are taking their shares for allowing transactions via their portals.

How does SEPA work in the B2B environment?

The European Commission and the European Central Bank’s intention in integrating the SEPA countries were to make European payments as simple and inexpensive as domestic payments are. And It has been achieved by establishing a unified market for euro-denominated payments.

To that end, the European Payments Council (EPC) set up three SEPA credit accounts:

- SEPA Direct Debit (SDD)

- SEPA Credit Transfer (SCT)

- SEPA Cards Framework (SCF)

In contrast with price skimming, there is price penetration. The main idea of it is to release a new product at the lowest price possible. In general, this is a strategy that can be used for lower-cost items or if you are targeting a bigger but more price-sensitive customer segment. The overall goal is to gain market share quickly.

For service providers, this method can be also beneficial to make customers try their new releases and to get used to new services at a lower switching cost. Good examples are household supplies or single-use products.

The common thing between the two methods is that they are both time-limited.

Each scheme is a combination of interbank “rules, procedures, and standards” that define a certain payment instrument.“

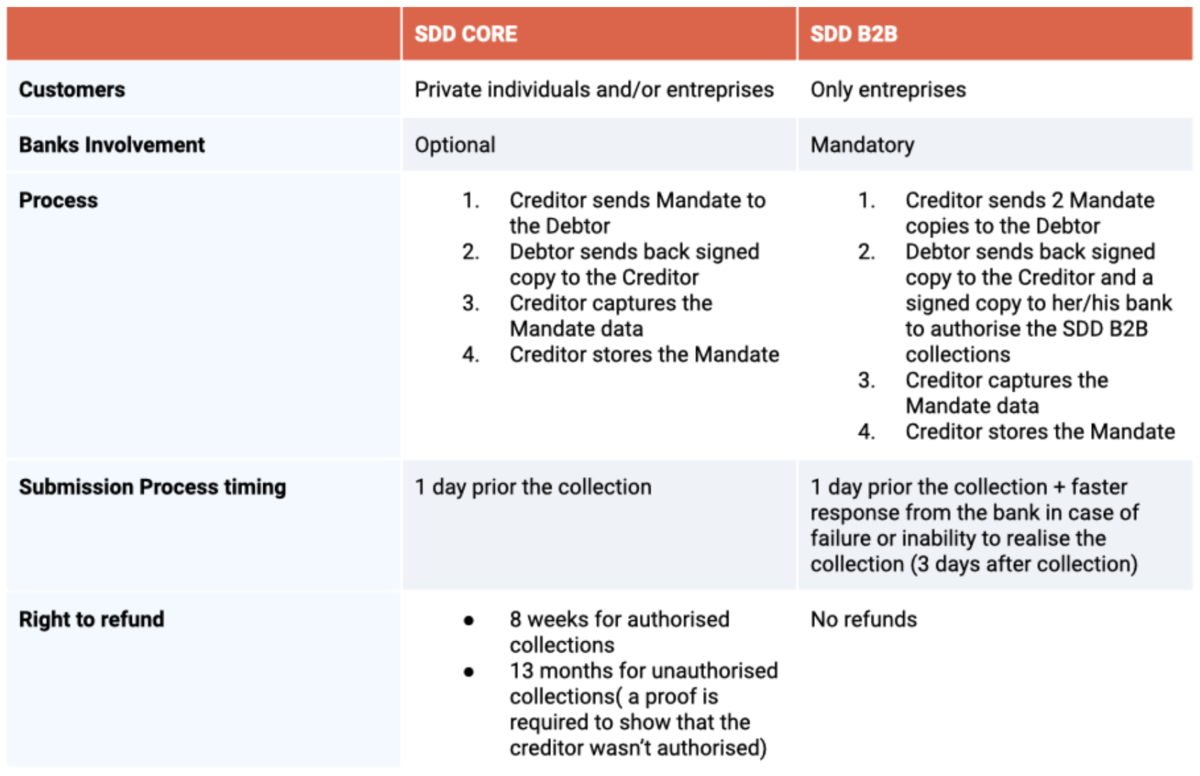

SEPA Direct Debit (SDD) refers to two schemes: SEPA Core Direct Debit and Business-to-Business Direct Debit. In a nutshell, the B2B plan is only available if you take Direct Debit payments from other companies. The justification for adopting SEPA B2B Direct Debit is, though, the same as in personal cases. Read the next chapter to learn more about the 5 most important things you should watch out for if you consider supporting SEPA B2B direct debit payments.

5 must to knows bout SEPA B2B Direct Debit

Frist, SEPA payment can seem like a convenient and easy payment method to offer for your retailers. However, there are a few things you should think through before you make any commitments. Especially, you should check with your bank about the obligations that will come with supporting SDD.

- You can benefit from this type of payment only if you run an enterprise.

- As a business owner, you must make sure that your company can accept direct debit payments.

- Most of the time, your organisation has to have an agreement with the bank to accept direct debits as a payment.

- B2B customers of SDD are not entitled to refunds. This should be communicated in your terms & conditions.

- Once all is set, the release of the collections happens faster and the bank let you know in case of any error within 3 days.

To have a better overview of the pros and cons, check the following infographic. We also wrote an article about other features you should support in your Wholesale eCommerce.

Conclusion

All in all, if your wholesale is doing business in the SEPA country zones, it is significant that your business account is also supporting SEPA payments. Once it does, then you are ready to benefit from the cheaper and faster money transfer options.

At Turis it is our mission to support B2B eCommerce in automating and simplifying their processes including different payment methods. Therefore, it has been our goal for a while now to start supporting SEPA payments as well.

This way, our users can provide the best customer experience for their retailers in the SEPA zones. Of course, SEPA is only beneficial if your order management is in the right place, in general.

Want to know how?

Book a meeting with our founder Casper. He will show you how Turis will benefit and grow your business.

Book meeting with Casper

RELEVANT POSTS