Feature of the month: Special Tax Lists

In B2B transactions, tax regulation compliance can cause many headaches. Not to mention that it can be a tedious task and can lead to costly mistakes especially when done manually. This is even more complex for businesses operating in multiple regions or dealing with varied product categories. That is where Turis’ Special Tax Lists come into play to facilitate and automate the B2B transactions. With this wholesale feature, businesses can simplify their tax management process and ensure compliance with different tax regulations and requirements across several regions or product categories effortlessly.

What are Special Tax Lists?

Special Tax Lists are a powerful B2B wholesale feature available in Turis. This B2B feature allows businesses to assign different tax or VAT rates to specific wholesale products in their B2B eCommerce platform. This feature simplifies the tax management process and gives the power back to businesses by correctly applying varying tax rates based on product categories, regions, or regulatory requirements.

Why are Special Tax Lists important?

Special Tax Lists are an important B2B wholesale feature, as they help businesses be tax-compliant in their B2B transactions and create flexibility when operating in diverse markets. Another key important reason that makes this feature a game changer is that it saves time, time that can be spent on other more important tasks. So now businesses be sure that they are tax compliant in their tax calculations transactions with retailers and avoid penalties or costly errors associated with incorrect tax rates.

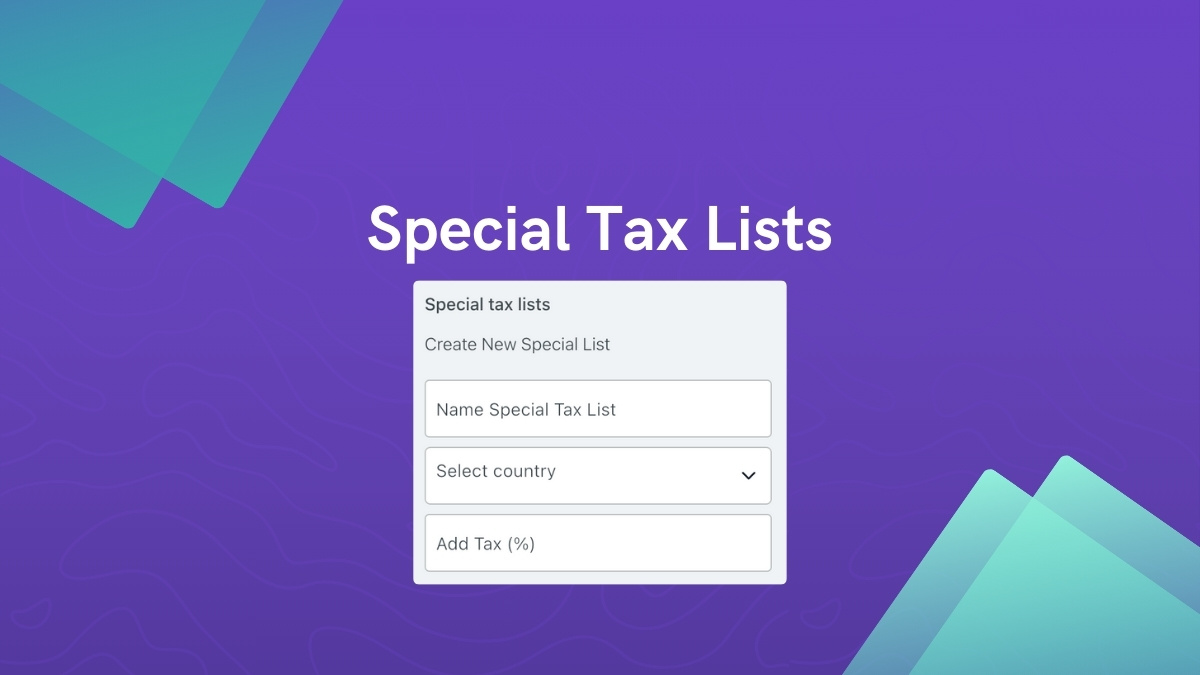

Where to locate Special Tax Lists in Turis?

Special Tax Lists can be found and managed by going to Settings > Tax > Special Tax Lists in Turis platform. In this section the user can create or edit the products by choosing to assign specific tax lists to individual items directly within the product settings. The straightforward interface makes the setup process easy, allowing for an efficient and time saving tax rate configuration for the different products whilst ensuring accurate and automated tax calculations during the retailers’ ordering process.