B2B payment gateway: What it is and Turis top 3 options

Learn what a B2B payment gateway is and discover the top 3 options offered by Turis. Learn how Turis simplifies B2B payments and enhances your B2B eCommerce payments for seamless transactions.

In the world of B2B (Business-to-business) eCommerce, choosing the right payment gateway processor and methods is part of a smooth experience when running B2B operations and to ensuring that your clients are not only paying clients but that they are also happy paying clients.

Meaning that they will continue to submit orders through your B2B eCommerce platform over and over again.

This guide will walk you through the essentials of B2B payment gateways, the benefits they offer, and how Turis supports seamless B2B payment integrations for your business.

What are B2B Payments?

B2B payments refer to transactions where businesses pay other businesses for goods or services. This process involves secure and efficient payment methods designed to business needs. B2B eCommerce payments has a wide range of digital payment solutions that facilitate smooth transactions between companies. Using advanced payment technology and integration via API, businesses can streamline their B2B payment processes, handle larger transaction volumes, and manage complex payments. This makes B2B eCommerce payments vital for ensuring operational efficiency and maintaining strong business relationships.

What is a B2B Payment Gateway?

A B2B payment gateway allows businesses to receive digital payments from other companies. This secure payment technology links your payer to a digital payment processing service. Using an API, you can integrate a payment gateway into your business app or website. Unlike B2C payment gateways that handle individual consumer transactions, B2B gateways are designed to manage larger volumes and more complex transactions, catering specifically to business needs. This makes B2B payment gateways essential for streamlining B2B eCommerce payments.

10 Benefits of B2B Payment Gateways for eCommerce

B2B payment gateways are essential for wholesale businesses looking to streamline their payment processes and improve B2B operational efficiency. We have gathered 10 benefits:

1. Improved Efficiency

B2B payment gateways automate several payment tasks. They eliminate the need for manual work and reduce errors. This optimization allows for businesses to work with high transaction volumes more efficiently, saving time and resources.

2. Scalability

As businesses grow, B2B payment gateways give the flexibility to manage increased transaction volumes without leaving behind performance. This ensures that companies can scale as their customer base expands, supporting growth without the need for change or disruption of the digital setup.

3. Security and Fraud Prevention

These gateways use by nature advanced security measures such as encryption, tokenization, and two-factor authentication to protect sensitive financial data. This setup ensures a high level of security to the whole infrastructure thus helping businesses operate confidently. Reducing the risk of fraud and ensuring compliance with regulatory standards.

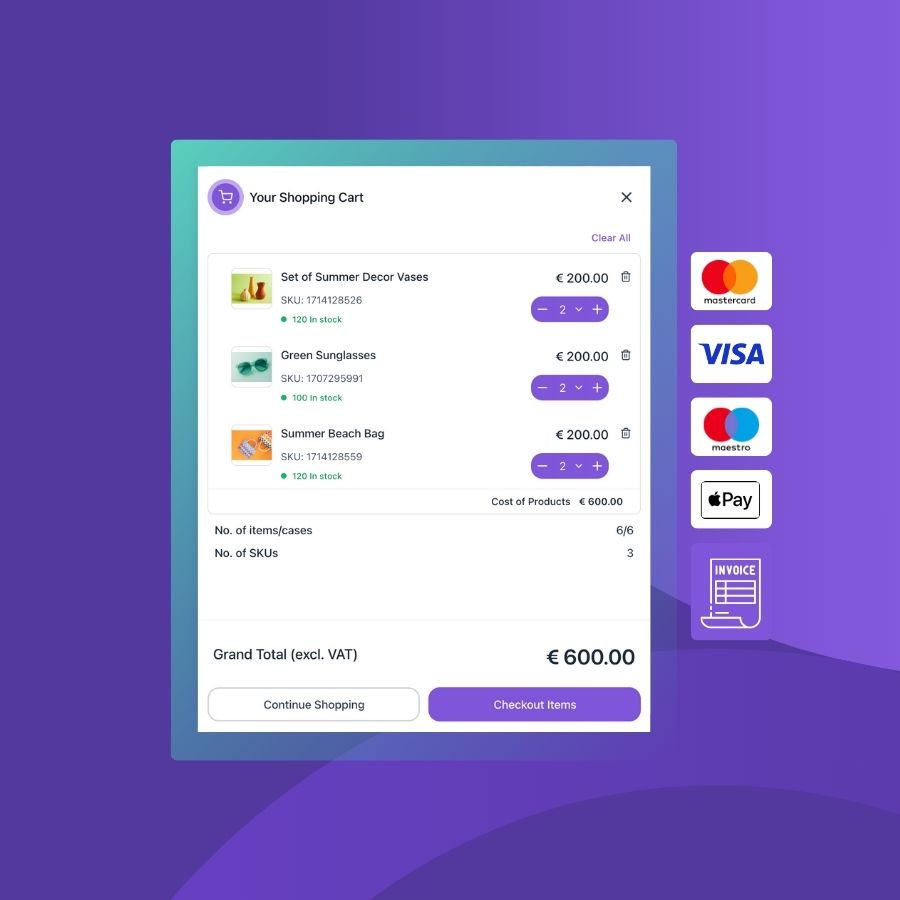

4. Multiple Payment Options

B2B payment gateways support a variety of payment methods, including credit cards, ACH transfers, virtual wallets, and electronic fund transfers. This gives businesses a competitive advantage by enabling them to cater to customer preferences, improving convenience and satisfaction, and potentially increasing sales by accommodating different payment habits.

5. Payment Tracking and Reporting

Comprehensive tracking and reporting features enable businesses to monitor payment statuses, view transaction histories, and generate detailed financial reports. These insights help getting a better financial management, cash flow forecasting, and identifying trends or discrepancies in payment patterns, which can inform strategic business decisions.

6. Integration Capabilities

B2B payment gateways can integrate with existing business systems like accounting software, ERP systems, and CRM tools. This integration streamlines B2B payment processing, eliminates manual data entry, and boosts overall business efficiency by ensuring data consistency across platforms.

7. Improved Security

Advanced security measures protect sensitive data, ensuring transactions are secure. Features like fraud detection and prevention tools, secure encryption protocols, and regular security audits help maintain a safe transaction environment, building trust with your customers and partners.

8. Faster Processing Times

Streamlined transaction processes lead to quicker payments, improving cash flow. Faster processing times mean that businesses can receive funds more rapidly, enhancing liquidity and enabling them to reinvest in operations or cover expenses promptly.

9. Improved Cash Flow Management

Efficient management of incoming and outgoing payments helps businesses maintain healthy cash flow. B2B payment gateways provide tools for tracking payments in real-time, setting up automatic billing cycles, and reconciling accounts efficiently, which can reduce financial stress and improve fiscal health.

10. Increased Customer Trust

Reliable payment processing enhances customer confidence and trust in the business. When customers know their transactions are secure and processed quickly, they are more likely to continue doing business with you.

Who Benefits from B2B Payment Gateways?

Wholesalers

Streamlined Bulk Transactions: Wholesalers often manage large orders and bulk transactions. B2B payment gateways simplify wholesale payments through automated payment workflows and by reducing manual errors. This streamlining ensures that payments are processed quickly and accurately, allowing wholesalers to focus on growing their business rather than managing complex payment systems.

Distributors

Efficient Management of Multiple Supplier Payments: Distributors frequently interact with multiple suppliers, requiring efficient payment management. B2B payment gateways provide a centralized platform to handle all supplier payments, ensuring timely and accurate transactions. This efficiency helps maintain strong supplier relationships and optimizes the distributor’s cash flow management.

Manufacturers

Smooth Handling of Large-Scale Orders: Manufacturers deal with high-volume orders and need reliable payment processing to keep operations running smoothly. B2B payment gateways facilitate the handling of large transactions by integrating with ERP systems and providing real-time payment updates. This integration cust down the administrative workload and ensures that manufacturers can keep up production schedules without financial disruptions.

Retailers

Simplified Payment Processes for Large Inventories: Retailers managing large inventories need streamlined payment solutions to handle several transactions efficiently. B2B payment gateways offer multiple payment options, automated billing, and detailed transaction reporting. These features simplify the payment process, making it easier for retailers to manage their finances and maintain accurate inventory records.

Key Essential Features of B2B Payment Gateways

- Customizable Payment Terms: Tailored payment options to fit business agreements.

- Multi-Currency Support: Handle international transactions with ease.

- Bulk Payment Processing: Manage large volume transactions efficiently.

- Automated Invoicing: Reduce manual entry errors with automated billing.

B2B Payment Gateway Integration with Turis

Integrating a payment gateway with your B2B eCommerce platform is essential for smooth operations. Here’s how:

- Select a Gateway: Choose the best gateway for your business needs.

- API Integration: Use APIs to connect the gateway with your eCommerce platform.

- Test Transactions: Ensure everything works seamlessly before going live.

- Monitor and Adjust: Continuously monitor performance and make necessary adjustments.

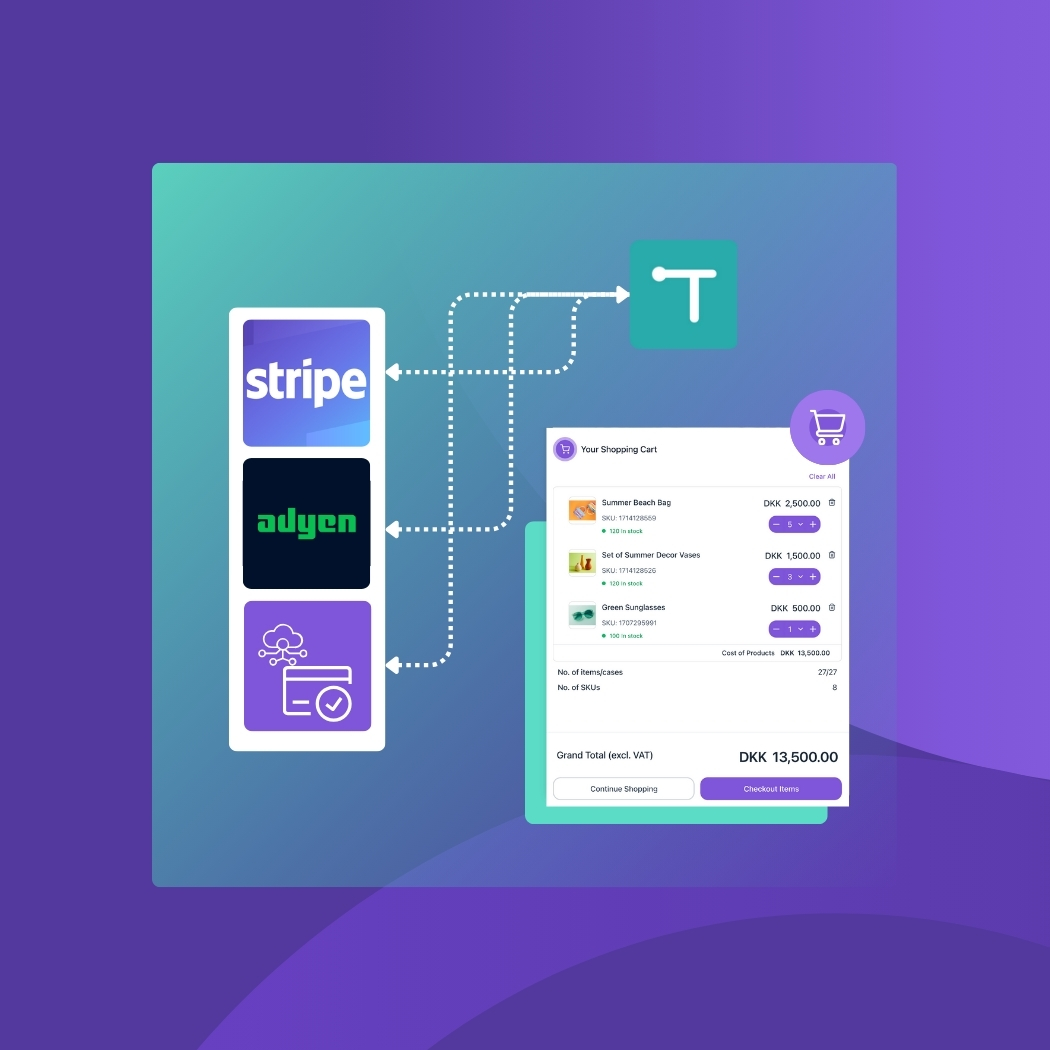

Turis Top 3 Payment Gateways

Turis supports 3 online payment processing solutions to make your B2B transactions smooth and efficient:

Stripe

- Pros:

- Easy to set up and use.

- Flat-rate pricing with complete transparency.

- No implementation, cancellation or monthly subscription fees.

- Supports more than 135 currencies.

- Automatically manages foreign currency conversions.

- Open API for advanced customization.

- 24/7 customer support.

- Cons:

- Transaction fees can be high for large volumes.

- Limited support for certain high-risk industries.

For a more detailed analysis of the pros and cons of stripe, you can visit Nerdwallet review.

Adyen

- Pros:

- Easy to set up and use.

- Supports a wide range of payment methods globally.

- Improved authorization rates and reduced transaction fees through local processing

- Robust fraud detection and prevention.

- Seamless integration with various platforms.

- Cons:

- High transaction fees.

- Complex pricing model.

- Minimum invoice amount required.

- Complexity in configuration for small businesses.

For a more detailed analysis of the pros and cons of Adyen, you can visit Nerdwallet review – Adyen.

Bring Your Own

- Pros:

- Flexibility to use any preferred payment gateway.

- Potentially lower transaction fees.

- Customizable to specific business needs.

- Cons:

- Requires more technical expertise for integration.

- May lack unified support and management.

How Turis Helps with Easy Payment Gateway Integrations

Turis makes it simple to integrate payment gateways into your B2B eCommerce platform:

- Intuitive Setup: Quick and easy setup process.

- Multiple Gateways: Support for various payment gateways.

- Seamless Integration: Smooth integration with existing systems.

- Real-Time Updates: Stay informed with real-time transaction updates.

Choosing the right B2B payment gateway is vital for your business’s growth and efficiency. Turis simplifies B2B eCommerce payments, by helping you manage transactions effortlessly and support business expansion. Explore Turis to find the comprehensive B2B payment solution that meets your needs.