5 Critical Wholesale Payment Challenges and Solutions

Finding practical solutions to the inefficiencies of B2B wholesale payments

Wholesale payments are central to the B2B (business-to-business) world, they facilitate transactions between businesses on a massive scale. However, setting up a reliable and efficient system for B2B payments comes with its challenges. In this article, we’ll go through the top 5 challenges businesses usually face in large payments and offer strategies that overcome them.

If you are as well interested in the benefits and drawbacks of wholesale payments this article can help you navigate these questions. Additionally, we will introduce how Turis helps companies addressing these challenges in B2B eCommerce.

1. Complex wholesale payments

One of the main challenges of multi-factor payments is the potential complexity of scheduling payment processes. Unlike customer transactions or B2C (Business to Customer), wholesale payments often involve multiple departments, large volumes, and very complex invoicing and reconciliation processes This level of complexity can lead to delays, errors and downtime it doesn’t do well in the B2B payments industry.

Solution: To use a B2B eCommerce platform that streamlines payment processing by automating invoicing, reconciliation and payment tracking. With products designed specifically for B2B transactions, Turis simplifies the payment process for both buyers and sellers, reducing the chances of errors and delays.

2. B2B cash flow management

B2B cash flow management is another important challenge for companies involved in large-scale payments. Balancing incoming and outgoing payments, managing extended payment terms and ensuring adequate funding is a concern for wholesalers and suppliers always.

Solution: Turis provides wholesale management tools that optimize cash flow, allowing businesses to track payments and outcomes in real time. Through features such as customizable payment processing, automated reminders and cash flow forecasts, Turis empowers businesses to manage cash flow and optimize business capital.

3. Security and fraud prevention

Security is a major concern in high wholesale payouts, as large amounts of money are often transferred between entities. The risks of fraud, data breaches and payment disputes create significant risks to businesses involved in large-scale transactions.

Solution: Turis prioritizes security and fraud prevention, using advanced encryption protocols, secure payment gateways. Accredited for B2B e-commerce, Turis provides services for security infrastructure and unauthorized access.

4. Communication across borders

For businesses engaged in international trade, cross-border transactions present unique challenges related to currency exchange rates, compliance, and geopolitical risks, and coordination and planning are required to meet the complexities of B2B cross-border payments.

Solution: Turis offers a wholesale platform tailored for cross-border transactions such as multi-currency support and global payment networks.

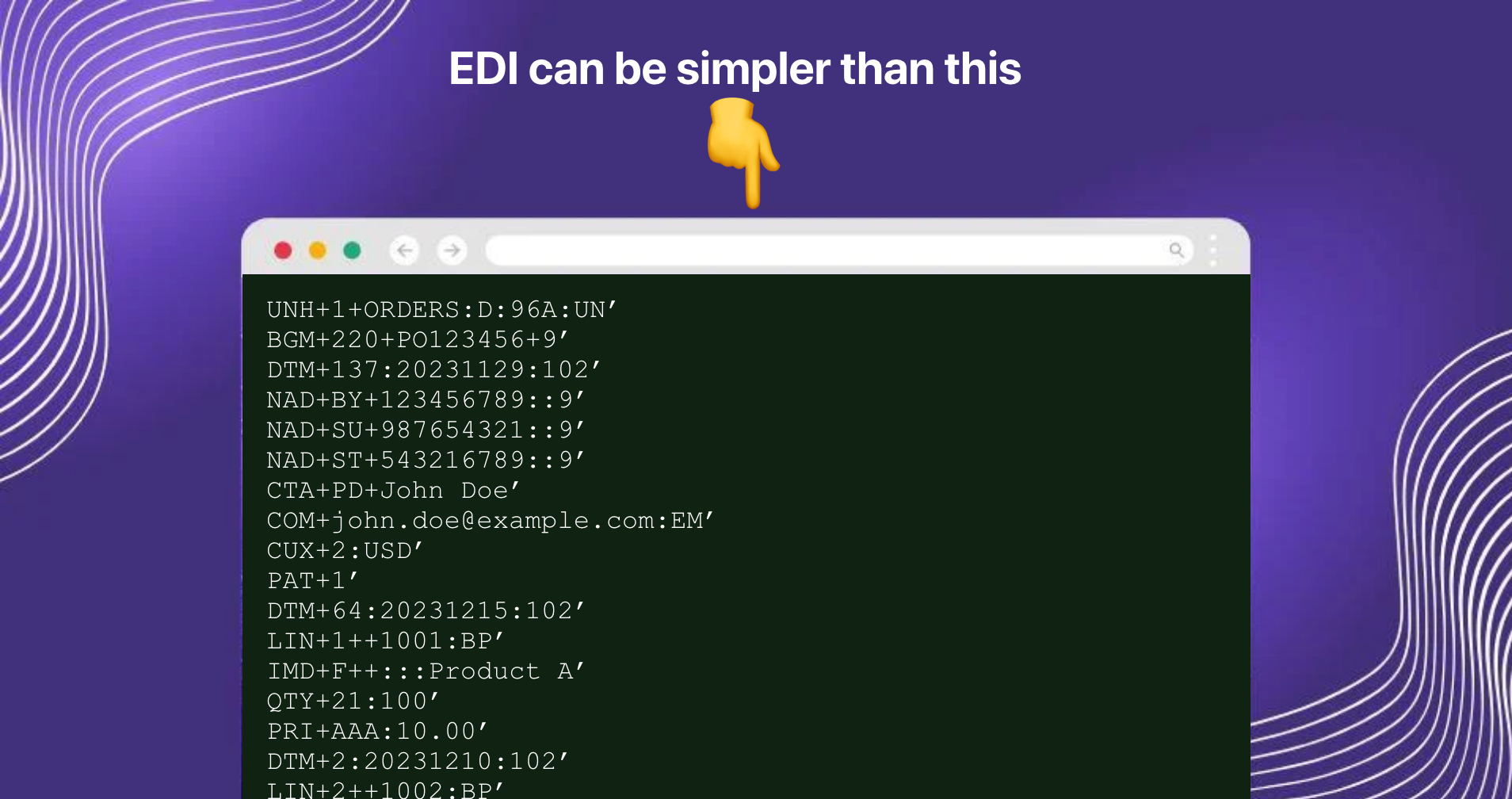

5. Integration with accounting systems

Integrating B2B payments into the standard accounting systems is an essential part of the wholesale industry. Extracting accurate financial statements is necessary for the reporting stage. However, compatibility issues, data errors, and human manual data entry can hinder the integration of payment data into accounting software.

Solution: Turis integrates with popular accounting systems like e-conomic, QuickBooks and Xero. This setup allows automatic workflows that consolidate payment invoices and enable easy access to financial statements.