A simple guide to VAT rules and taxes in B2B eCommerce in Europe

If you run a B2B eCommerce business in Europe, understanding VAT (Value-Added Tax) is essential to ensuring smooth B2B operations and avoiding fines. Each country in Europe has its own VAT rules and rates, and different products or industries might have special rates or exemptions. For B2B eCommerce brands, it’s important to get the different products pricing right by adjusting for these differences. Not only for the sake of accuracy in terms of legislation but also to ensure that you don’t have any unpleasant surprises.

So now, let’s break down how VAT works in Europe and what B2B eCommerce businesses need to know about handling VAT across different countries and products. Plus, how you can also set differentiated pricing for your retailers, efficiently manage and keep track of all your pricing agreements.

What is VAT (Value-Added-Tax)?

VAT is a tax on goods and services that gets added to the final price of a product. In B2B transactions, businesses typically pass on VAT to their customers and then report and pay the tax to the government. However, the VAT rate and rules can vary depending on the country and the type of product or service you’re selling. For example, in Germany, the standard VAT rate is 19%, but for products like books, a reduced rate of 7% applies.

Different VAT rates across Europe

Each country in Europe has its own VAT rate, you can find all the different VAT rates in INTRAVAT. For example:

- Germany has a standard VAT rate of 19%.

- France has a standard VAT rate of 20%.

- Sweden applies 25% VAT.

These rates apply to most goods and services, but some countries have reduced VAT rates for specific industries or types of products, such as food, medical supplies, or digital services.

Example: Reduced VAT rates

- In Spain, there’s a reduced VAT rate of 10% for certain food items and services.

- Ireland offers a reduced VAT rate of 13.5% for tourism-related services and energy products.

As a B2B eCommerce business, it’s important to know the VAT rules of the countries where you sell, especially if you’re offering products in these categories. You may need to adjust your product prices or calculate VAT differently depending on where your buyers are located.

How VAT works in B2B eCommerce

In B2B transactions, VAT is often “reverse charged.” This means that instead of charging VAT to your business customer, they self-account for VAT on their purchase. For example, if a German company sells products to a French business, the French business will be responsible for reporting and paying VAT under the reverse charge mechanism.

However, if you sell goods or services to a business in the same country, VAT must be added to the price. The challenge for eCommerce businesses is knowing when to apply VAT and at what rate, depending on the buyer’s location and VAT status.

Adjusting pricing for VAT in B2B eCommerce

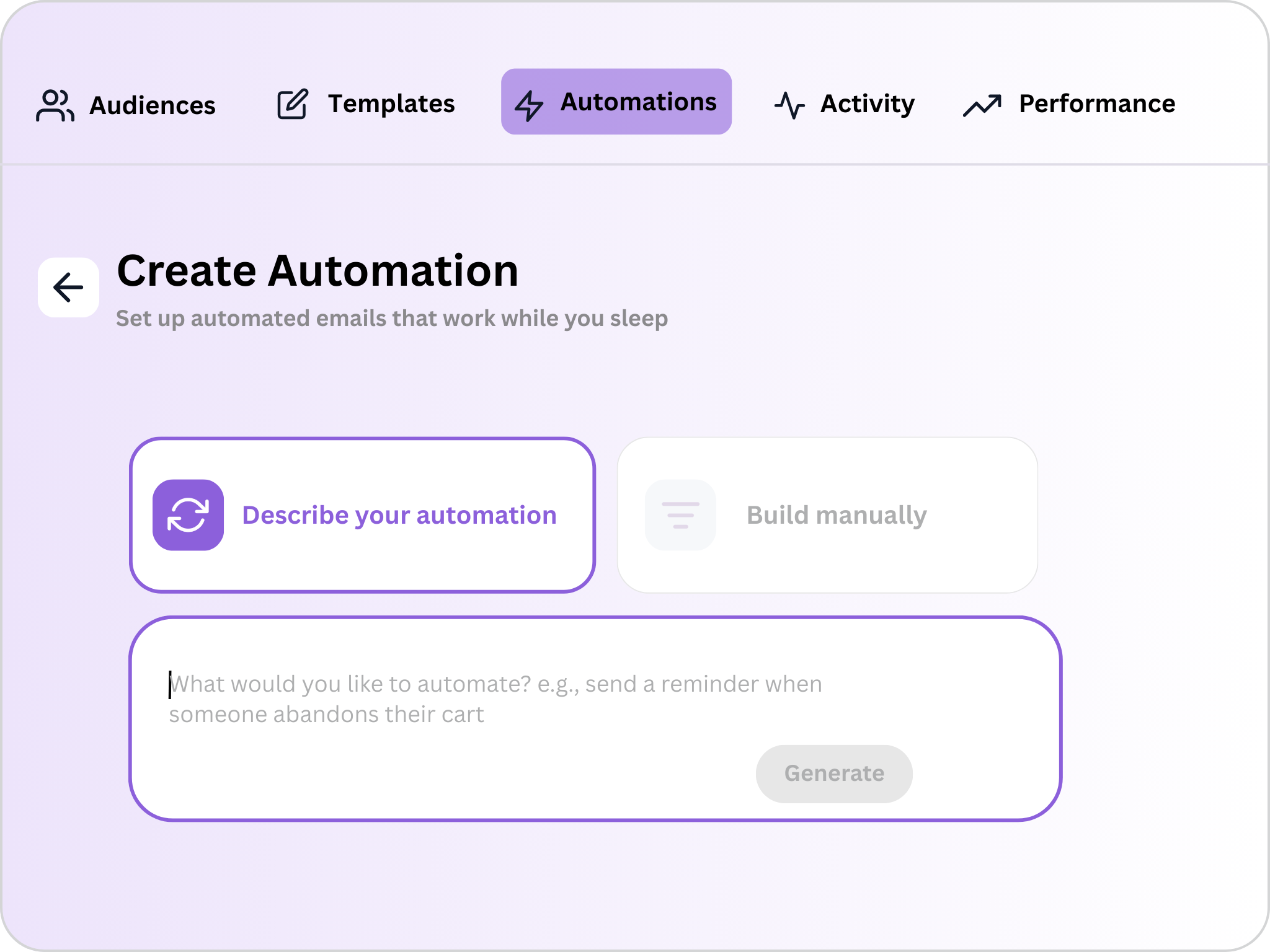

For B2B eCommerce brands, it’s essential to build the correct VAT into your B2B pricing structure. This could mean having different prices for different buyers depending on their country and whether they are subject to VAT. Some B2B eCommerce platforms like Turis allow you to automatically adjust the VAT added to the purchase based on where your customer is located. For example, a B2B buyer from Germany would see prices with 19% VAT added, while a B2B buyer from Sweden would see 25% VAT.

VAT compliance and registration

If your B2B eCommerce business sells to multiple countries within the EU, you may have to register for VAT in each of one of those countries. This ensures that you collect and remit the correct amount of VAT based on the different local rules.

Luckily, Europe introduced the One-Stop-Shop (OSS) scheme, this simplifies VAT compliance for businesses selling across borders in the EU. With OSS, businesses can register for VAT in one EU country and manage VAT for all other EU countries through that single registration.

How Turis helps businesses manage VAT in B2B eCommerce

Handling VAT across multiple countries can be challenging for any B2B eCommerce brand. Managing different VAT rates and ensuring compliance with local tax laws involves many moving parts. That’s where Turis comes in—Turis simplifies VAT management, helping businesses navigate these complex rules with ease. The Turis B2B eCommerce platform includes a unique feature, the Special Price List, which streamlines the process of setting up tiered VAT rates, making it easy to manage VAT across different products and regions.

Here’s how Turis can help your business manage VAT in B2B eCommerce:

1. Automatic VAT calculation

Turis automatically calculates the correct VAT based on the buyer’s location, making it easy for you to handle different VAT rates across Europe. Whether your customer is in Germany (19% VAT) or Sweden (25% VAT), Turis ensures that the right amount of tax is applied to the purchase, so you don’t have to manually adjust your pricing.

2. Supports VAT-exempt transactions

For businesses making VAT-exempt or reverse charge transactions, Turis allows you to manage VAT-free sales to other EU countries seamlessly. Turis recognizes when a customer qualifies for VAT exemptions and automatically applies the correct tax rules, ensuring you remain compliant with EU tax laws.

3. Customizable pricing with VAT

Turis allows you to set up customized pricing based on your buyer’s location and VAT rules. This means you can adjust your prices to include the correct VAT rate for each market or display VAT-inclusive and exclusive prices, ensuring transparency for your customers. Additionally, you can create special price lists tailored to unique buyers or companies, offering custom pricing that suits their specific needs and agreements. This flexibility ensures that your pricing strategy is both dynamic and compliant with local tax regulations.

4. Seamless integration with accounting systems

Turis integrates easily with popular accounting systems like QuickBooks, Xero, and e-conomic, helping you manage VAT reporting effortlessly. With accurate, real-time data synced between Turis and your accounting software, you can simplify your VAT filing process and reduce the risk of errors.

5. VAT compliance for cross-border sales

Selling to multiple countries? No problem! Turis ensures that your B2B eCommerce platform is always VAT compliant, helping you manage taxes across borders, including under the EU One-Stop-Shop (OSS) scheme. With Turis, you can register for VAT in one EU country and manage VAT for all other EU countries through that single registration, making cross-border transactions hassle-free.

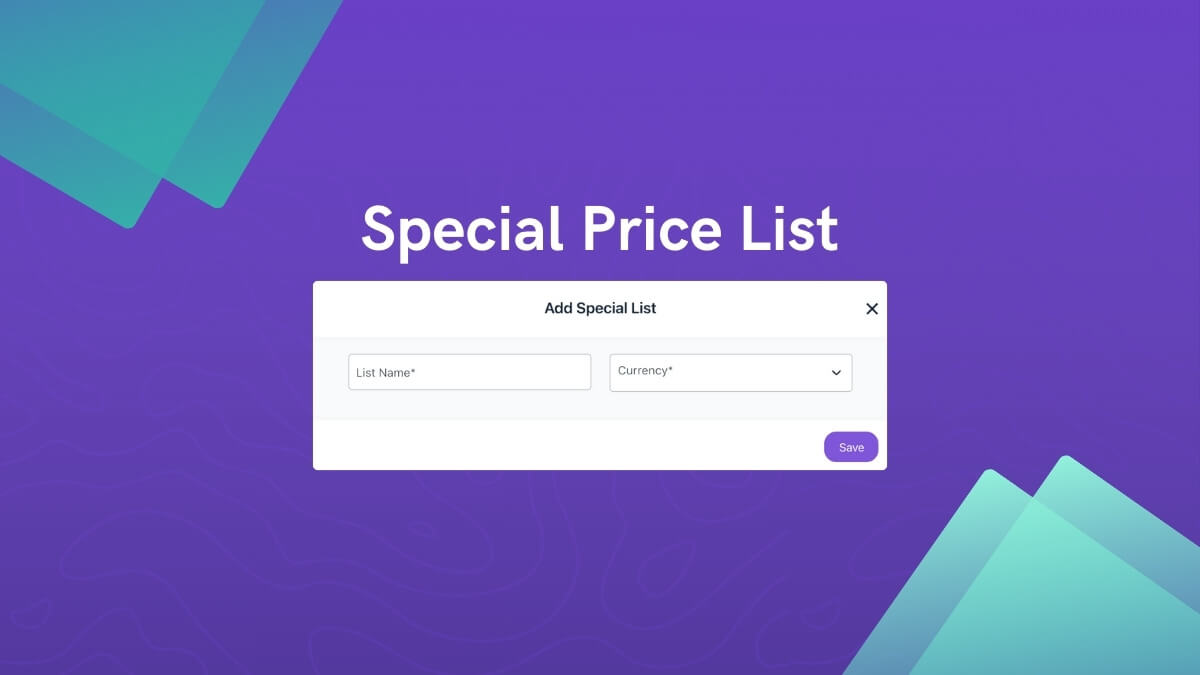

What is the Special Price List feature?

The Special Price List feature in Turis lets you create and manage custom pricing for selected retailers. This means you can offer discounts or specific prices on certain products to certain customers, making your pricing as flexible as your business needs it to be.

Not only can you adjust prices for different retailers, but Turis also allows you to set different prices based on VAT rules for specific products or regions. For example, if you sell both regular eyewear and medical eyewear, you can apply the normal VAT rate to regular eyewear while offering a lower VAT rate for medical eyewear.

Turis automatically applies the correct VAT rate depending on the product, so you don’t have to worry about keeping track of tax rules. Whether you need to adjust prices for different countries, regions, or product types, Turis makes it simple to manage complex pricing and stay compliant with VAT regulations. This gives you peace of mind while ensuring your customers see the right prices every time.

Conclusion

Understanding and implementing correctly the different VAT rules in Europe for B2B eCommerce can be complicated, but it’s manageable with the right B2B eCommerce platform. Understanding the different VAT rates across countries and products, knowing when to apply VAT, and adjusting your prices accordingly will help ensure your business stays compliant and profitable.

By staying on top of VAT rules, B2B eCommerce brands can avoid potential fines and offer a smooth shopping experience for their B2B buyers across Europe.