Tiered pricing strategies for B2B eCommerce: What you need to know

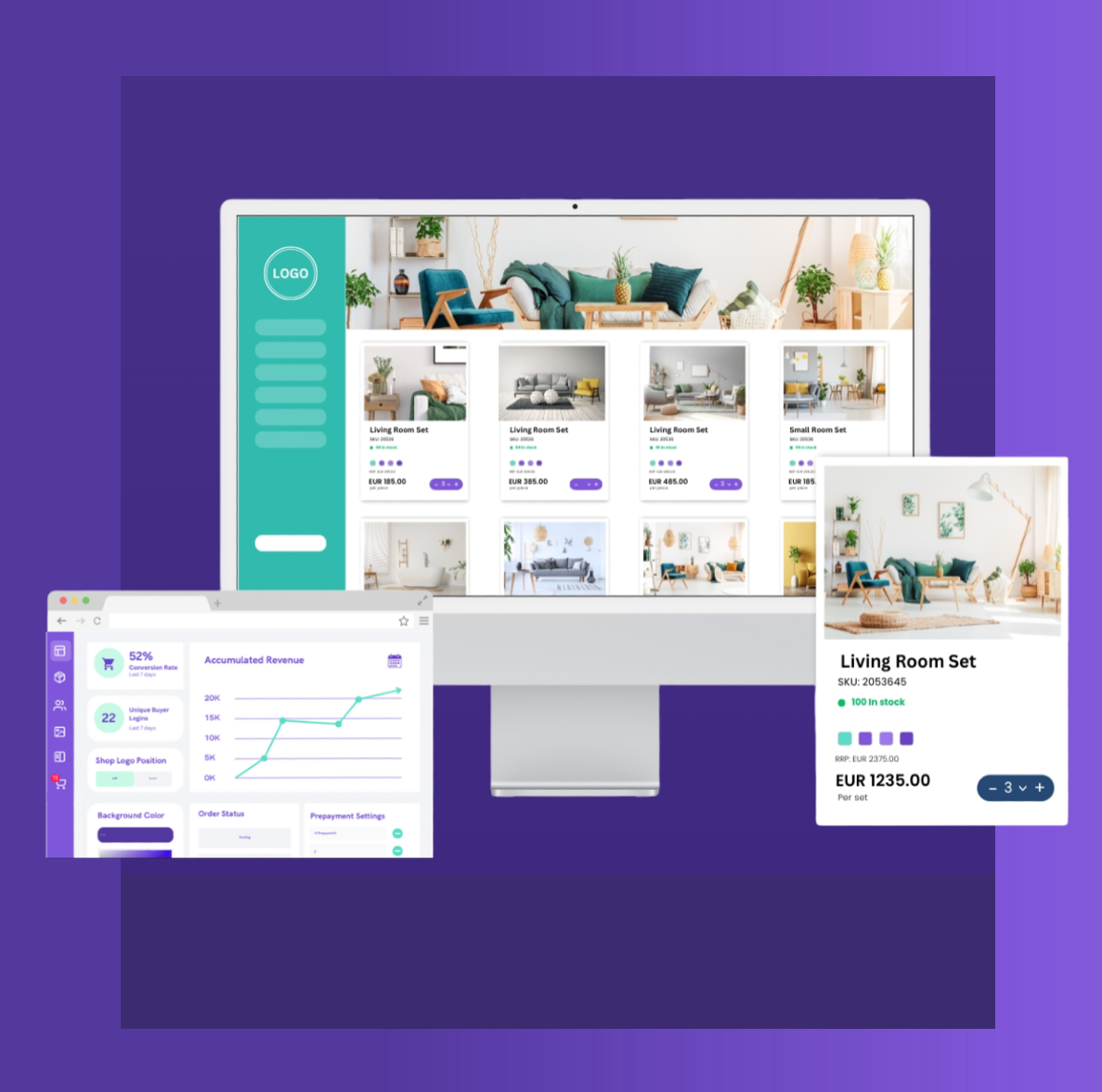

In B2B eCommerce, offering flexible pricing to your B2B buyers and managing tax settings efficiently is essential for staying competitive, streamlining your B2B operations, and fostering customer retention. Having a clear and solid tiered pricing strategy for your B2B business not only encourages larger orders but also creates stronger relationships with different customer segments in different markets. Paired with a strong B2B pricing strategy, efficient B2B tax management ensures that businesses remain compliant across multiple markets and don’t get surprised with fines.

Creating flexible B2B pricing with tiered pricing

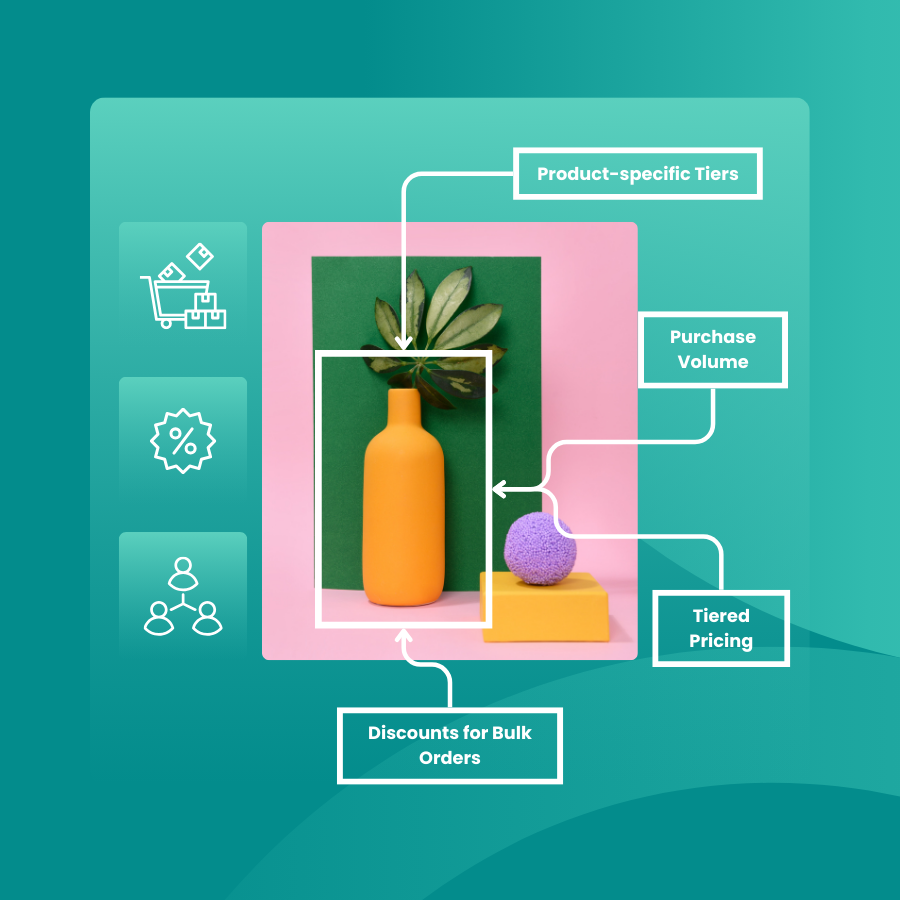

Tiered pricing allows businesses to offer different prices based on several factors, like purchase volume, product types, or customer groups. Being able to offer this flexibility is essential in B2B commerce, as buyers frequently buy in bulk and expect special pricing or discounts based on their order size or loyalty.

Key features of tiered pricing

Set different price levels based on purchase volume Tiered pricing enables you to create different wholesale pricing levels depending on different quantities of products. For example, offering discounts for larger orders gives B2B buyers an incentive to purchase more in one single transaction.

- Example: A buyer purchasing 100 units might get a 10% discount while buying 500 units could result in a 20% discount.

Automatically apply bulk discounts With automated tiered pricing, discounts are automatically applied to larger orders, simplifying the buying process and ensuring accuracy. Buyers don’t have to manually request discounts, which enhances the purchasing experience.

- Example: A buyer adds items to their cart, and as they increase the order quantity, the system automatically applies the appropriate discount based on predefined tiers.

Customize pricing tiers for specific products or customer groups Different products and customers may need unique pricing tiers. Tailor your pricing structure to suit customer-specific needs or product-specific scenarios.

- Example: High-value customers who have been loyal for years could receive exclusive discounts on premium product lines.

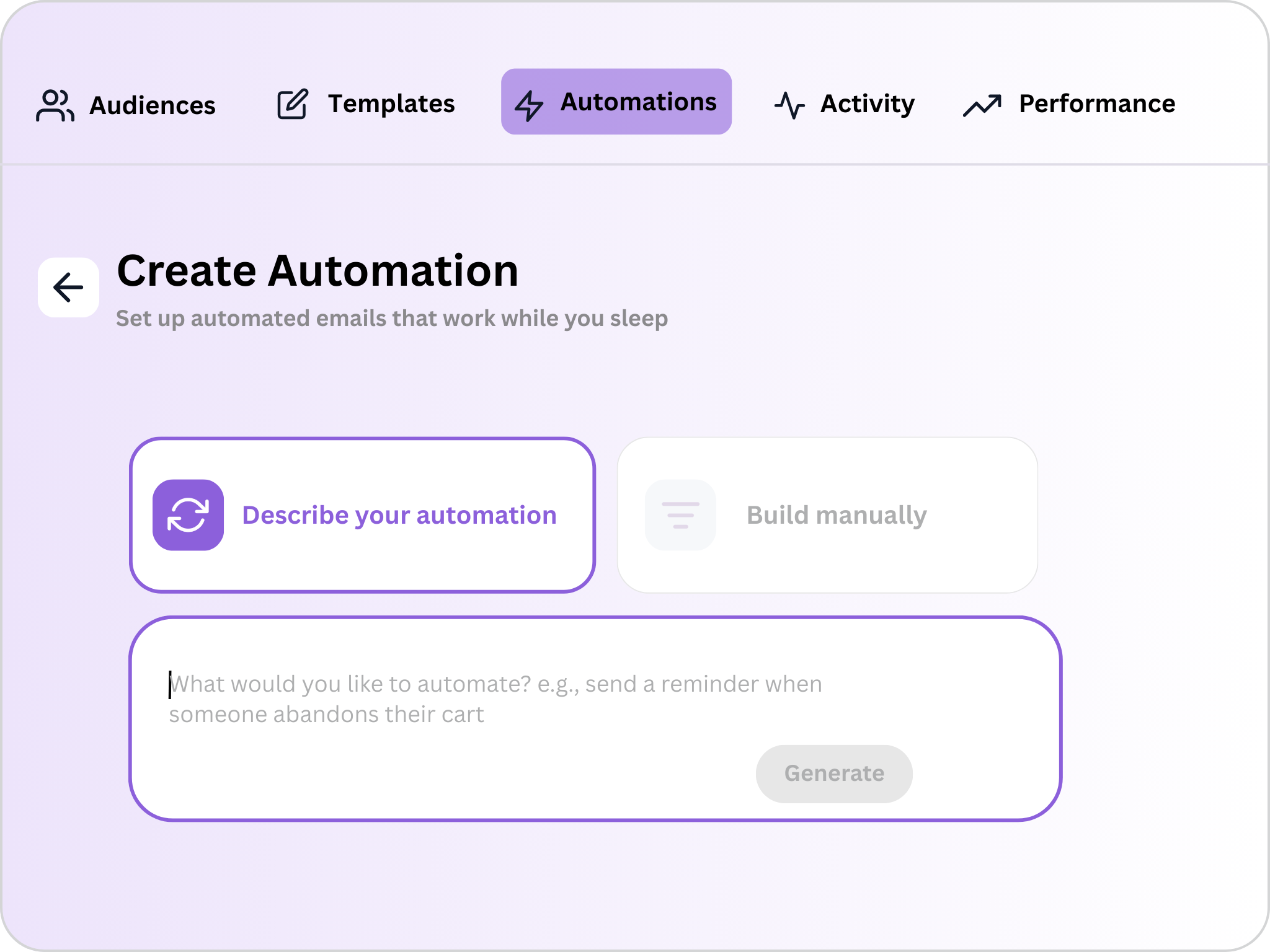

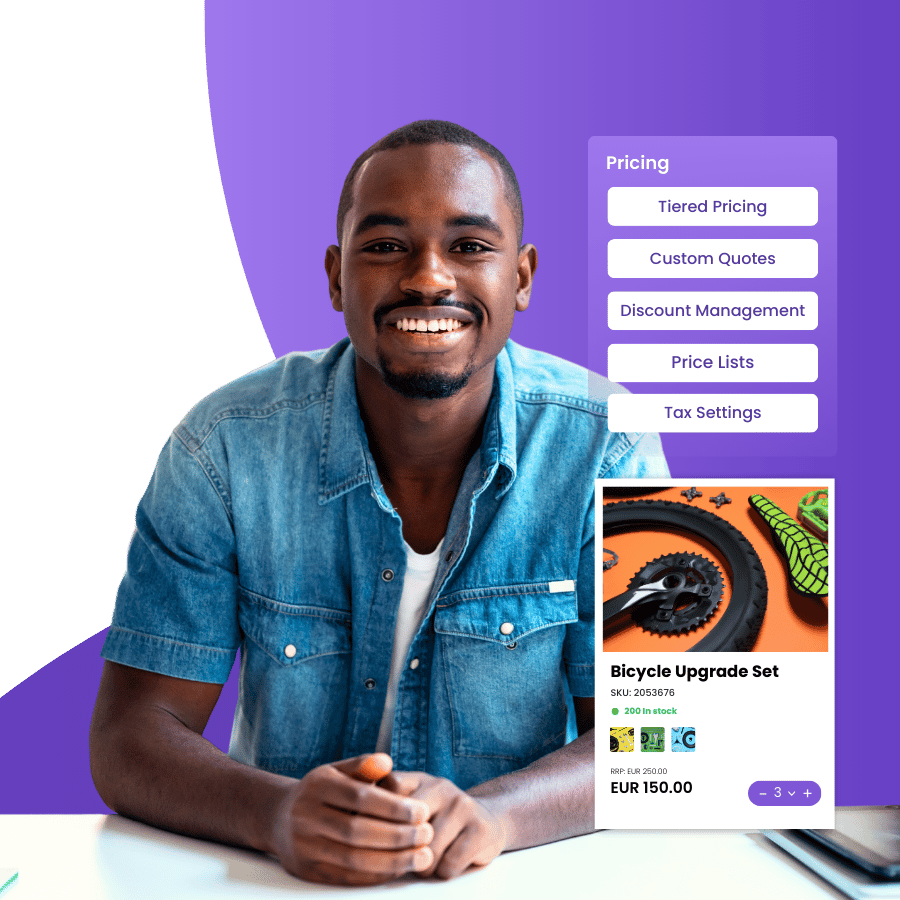

B2B pricing simplified: easiest way to control rules and exceptions

Tailoring pricing by product, customer or currency

Offering customized pricing to specific clients or product categories can give you a competitive edge. This is where the Turis Special Price List feature creates a streamlined pricing strategy, allowing B2B businesses to create buyer-specific, product-specific, and even currency-specific price lists.

Key features of Custom Price Lists

- Buyer-specific price lists Different buyers may require tailored pricing based on factors such as their location, order history, or buying power. With buyer-specific price lists, you can offer personalized pricing to each customer.

- Example: A key retailer might get a 5% discount on all orders, while another buyer receives a higher discount based on their buying history.

- Product-specific price lists Certain products may have distinct pricing tiers based on factors such as product category, exclusivity, or demand. Product-specific pricing allows you to apply different prices to different items in your catalog.

- Example: Premium jewelry products could have a higher pricing tier, while regular accessories may offer more discounts.

- Currency-specific price lists Selling to multiple countries often requires dealing with multiple currencies. By creating currency-specific price lists, you can adjust your prices for different markets, making your B2B eCommerce platform globally friendly.

- Example: A buyer in the U.S. might see prices in dollars, while a buyer in Europe would see the same items priced in euros, automatically adjusted for local rates.

Offering tailored discounts with Discount Management

Discounts are a big part of buying in bulk and can help build loyalty with your B2B buyers. With Discount Management, B2B businesses can offer flexible and customized discounts.

Key discount features

- Create discount vouchers Offer special discount vouchers to specific buyers, allowing them to redeem them during checkout for instant savings.

- Example: Send discount vouchers to high-volume buyers to encourage repeat purchases.

- Buyer-specific discounts Tailor discounts specifically for your most valuable buyers. Whether it’s a percentage off their total order or discounts on specific products, this feature helps you build stronger relationships with key customers.

- Example: Long-term clients receive a 15% discount on all orders placed within a month.

- Product-specific discounts Apply discounts to particular products or categories. This is especially useful for promoting slow-moving stock or seasonal items.

- Example: Offer a 10% discount on winter accessories to clear out inventory.

- Currency-specific discounts Provide discounts based on the buyer’s currency. This can help you remain competitive in different markets and ensure that all buyers receive a consistent discount, regardless of currency fluctuations.

- Example: Offering a fixed percentage discount across all currencies ensures price parity for global buyers.

Managing VAT and Tax regulations

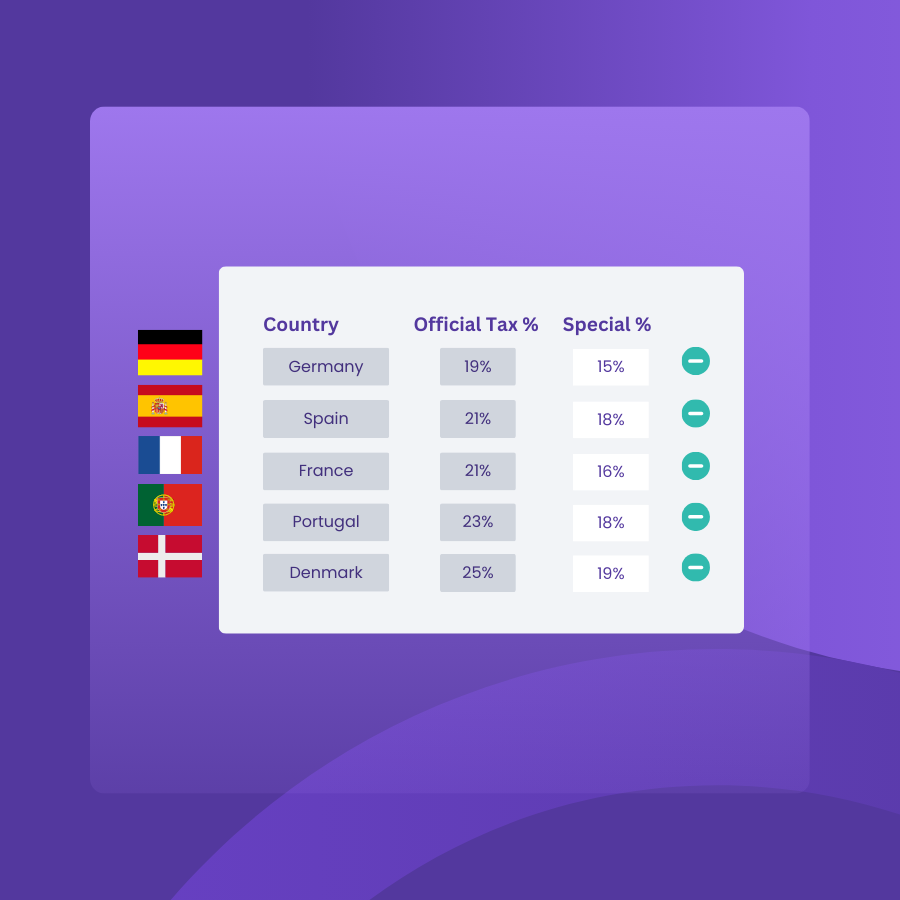

Managing taxes across different countries and regions can be a complex task, but with Tax Settings, B2B businesses can ensure compliance while remaining competitive in different markets. Custom tax settings allow businesses to adjust VAT or sales tax based on country-specific regulations or product-specific tax rules.

Key tax features

- Create product-specific tax lists Different products may have different tax rates depending on the country. With product-specific tax lists, you can apply the correct tax rates to each product, ensuring compliance with local regulations.

- Example: Luxury items like jewelry may have a different VAT rate than standard accessories.

- Set country-specific special discount tax rates Certain countries may offer special tax rates on specific products or under certain conditions. With country-specific tax settings, you can ensure that your business applies the correct tax rates for each region.

- Example: In one country, medical devices may have a lower VAT rate, while standard products are taxed at the full rate.

Conclusion

By making use of tiered pricing, custom price lists, and tax settings together as part of a B2B pricing strategy, businesses can offer a more tailored and inviting B2B eCommerce experience for their buyers. These features not only help businesses remain competitive but also provide flexibility in pricing and tax management, ultimately leading to better customer satisfaction and streamlined operations.

Whether you’re looking to offer bulk discounts, manage buyer-specific pricing, or ensure tax compliance, tools like these can help you scale efficiently in the B2B space.