The difference between ‘Total’ and ‘Subtotal’

What is the difference between the Total and the Subtotal?

If you are in any way selling or buying goods and services, you must know this. Especially if you are working with B2B and wholesale orders.

In this short blog post, we will share with you the difference between Total and Subtotal. Also, we are going to explain why it is important to use both – especially in B2B and wholesale transactions.

What is the Total?

First of all, we should point out that when we are talking about Totals and Subtotals, we mean the ones you would find on order confirmations, invoices, etc.

The Total of an order or an invoice is the absolute and final price the customer needs to pay. Other words for the Total are Grand Total or Order Total.

When a customer sees the Total, they know that nothing else will get added to this price. Everything is included: The prices of all products, discounts, shipping fees, transaction fees, taxes, etc. This is the amount they need to transfer from their bank.

What is the Subtotal?

On an invoice, the Subtotal comes before the Total. The term “sub total” actually means “below total”. So it’s less than the invoice Total.

There are different opinions on what to include in the Subtotal. Some include everything but the tax in the subtotal. In this case, order lines, discounts, shipping, and fees are all included.

Others only include the combined values of the sold products and services in the Subtotal. That means that stuff like shipping and transactions fees are not part of the Subtotal. Instead, these are only added to the Total.

The difference between Total and Subtotal

So essentially, the only difference between the subtotal and the total – in most cases – is the tax / VAT that is added to the order. (You can learn the difference between tax and VAT here).

The subtotal goes before the total and functions as an intermediate calculation that provides transparency and clarity to the customer.

The total tells the customer exactly how much to transfer to pay for their purchase.

In the event that you are not to charge your customer any tax or VAT (due to tax regulations on tax and VAT exemption), the total and subtotal could in fact be the same value.

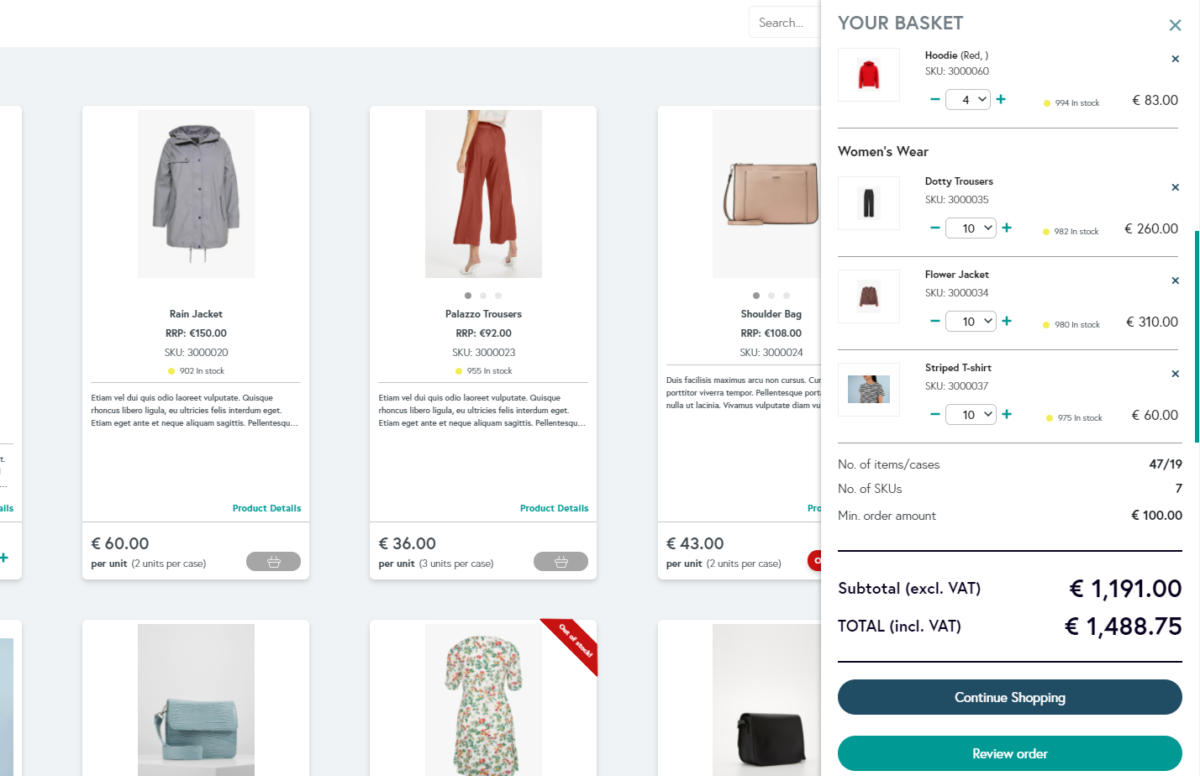

See the screenshot from a wholesale eCommerce platform below. Here the basket summary displays both the ‘Subtotal (excl. VAT)’ and the ‘TOTAL (incl. VAT)’. The difference between the two amounts is the 25% VAT added to the Subtotal.

Total and Subtotal in wholesale

While totals and subtotals are commonly used across multiple business models, it is especially relevant in wholesale and B2B transactions. The reason is that customers in such transactions are often exempt from paying taxes and VAT.

That is why a B2B customer – a retailer purchasing units for the store, for example – is very much interested in the price without taxes. The Subtotal, that is.

Even if the retailer needs to pay the total order amount including tax and VAT, they can get a tax or VAT refund later.

That is why it is especially relevant to display the subtotal when selling you your B2B and wholesale customers. And even though the wholesale customer knows that they can get the VAT refunded, showing the price without the VAT can have a positive psychological effect, encouraging them to order more. That is also why we recommend that you use eCommerce software that is dedicated to wholesale, to ensure that you can show prices without VAT. More on this in the next section.

Create your own wholesale E-commerce store completely free of charge. Sign up via the button below.

Wholesale E-Commerce software

Precisely because the difference between subtotal and total is so important in wholesale, it is very beneficial to use wholesale e-Commerce software that can easily handle the various totals.

Also, sometimes you might need to charge different tax levels for different countries. Charge different VAT levels for different products. Or only charge VAT for specific customers and not for others. So it can definitely make your life easier if your wholesale eCommerce system can handle all of these tax and VAT settings as well.

That is why – for most wholesale and B2B businesses – it is valuable to use a wholesale eCommerce tool designed to handle B2B transactions.