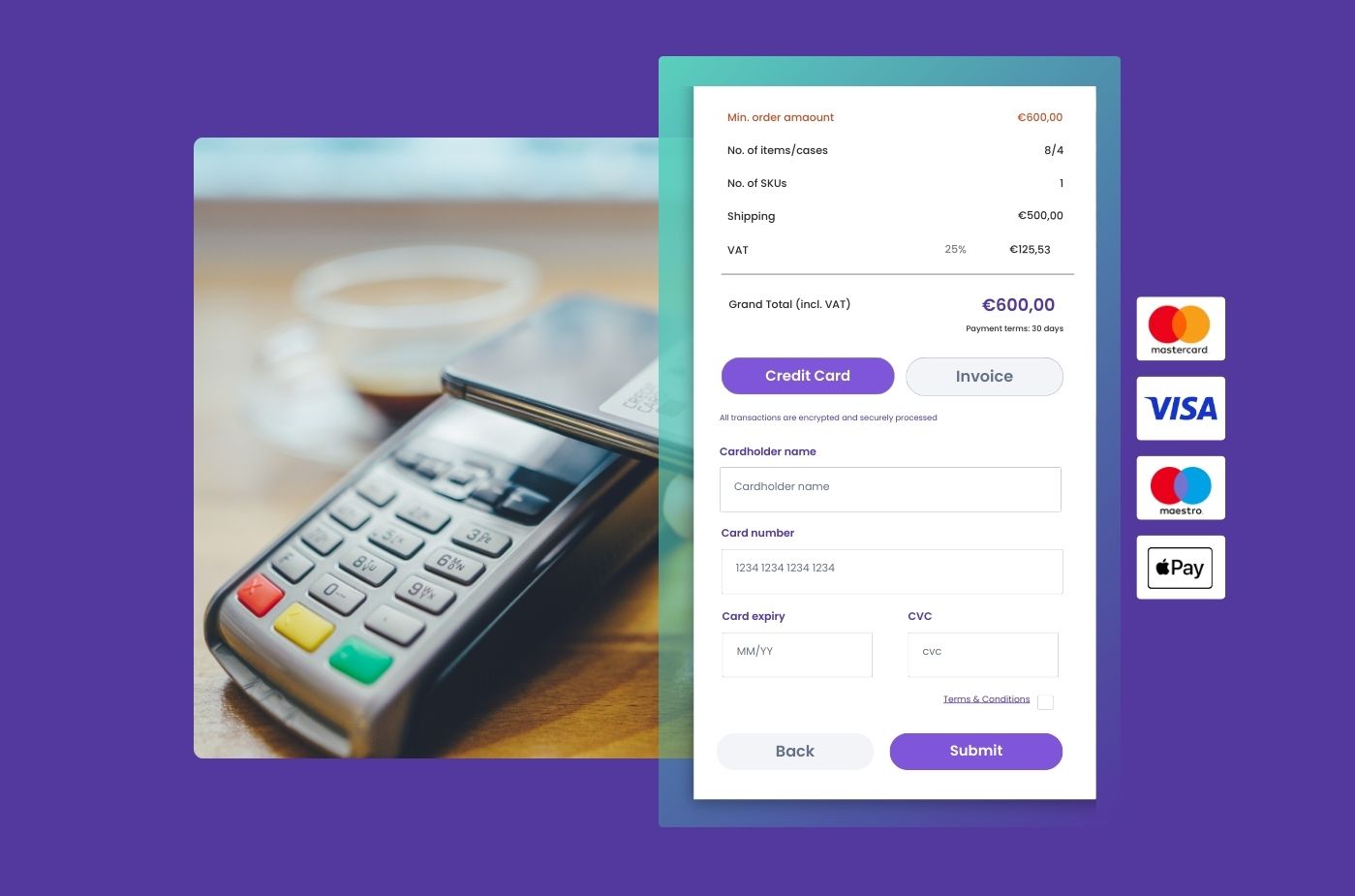

B2B Payment Terms: Choosing the right fit for your wholesale business

In the world of B2B eCommerce, payment terms play a crucial role in building strong relationships between suppliers and retailers. Unlike B2C transactions, which are typically settled at the point of sale, B2B transactions often involve negotiated payment terms that can significantly impact cash flow, business growth, and customer satisfaction.

Let’s explore the different types of B2B payment terms, their objectives, and how choosing the right option can benefit your wholesale business.

Types of B2B Payment Terms

Net Payment Terms (Net 30, Net 60, etc.)

- What It Is: This is one of the most common payment terms in B2B transactions. It means the buyer has a specified number of days (e.g., 30, 60, or 90) to pay the invoice amount after receiving the goods.

- Objective: Allows buyers more time to sell the products before payment is due, improving cash flow for the buyer while fostering trust and long-term relationships.

- Benefits: This term can attract larger buyers and increase order volume as customers are given time to manage their cash flow effectively.

Prepayment

- What It Is: The buyer pays the full amount before the goods are shipped.

- Objective: Minimizes risk for the supplier by ensuring payment is received before goods are dispatched.

- Benefits: Ideal for new customers, large orders, or custom products, as it reduces the risk of non-payment and helps maintain a steady cash flow.

Cash on Delivery (COD)

- What It Is: Payment is made at the time of delivery.

- Objective: Ensures the supplier gets paid as soon as the goods are delivered, reducing the risk of non-payment.

- Benefits: Useful for smaller, frequent orders and for businesses wanting to maintain a balance between trust and security.

Installment Payments

- What It Is: The invoice amount is divided into multiple smaller payments spread over an agreed period.

- Objective: Makes large orders more accessible to buyers, encouraging them to purchase more without a huge upfront cost.

- Benefits: This term can attract more buyers and larger orders, helping to increase sales and build customer loyalty.

Cash in Advance (CIA)

- What It Is: Full payment is required before the order is processed and shipped.

- Objective: Reduces the risk for the seller, especially in international trade or with new customers.

- Benefits: Provides immediate cash flow and minimizes the risk of non-payment, making it a good option for high-risk orders or first-time buyers.

Wholesale Payments – a Guide to the Benefits and Drawbacks

Choosing the right Payment Terms for your business

The choice of payment terms should align with your business goals and the needs of your customers. Here are some key considerations:

- Customer Relationships: Offering flexible payment terms like Net 30 can strengthen relationships with trusted buyers and encourage repeat business.

- Cash Flow Management: Prepayment or Cash in Advance can help maintain a healthy cash flow, especially for small businesses or those with tight margins.

- Risk Management: For new customers or large, custom orders, requiring prepayment or a deposit can reduce financial risk.

B2B Payment Gateway: What it is and Turis Top 3 Options

Conclusion

Selecting the right B2B payment terms is not just about choosing what works for your business—it’s about finding a balance that benefits both you and your customers. By offering the right mix of payment options, you can enhance customer satisfaction, improve cash flow, and ultimately drive the growth of your wholesale business.

Whether you’re a seasoned wholesaler or just starting out, understanding and leveraging B2B payment terms effectively can set you up for long-term success.